State of the industry 2023

Dive into the digits with our global fitness industry white paper, a no-nonsense analysis tailored for gym owners seeking real insights. We break down the trends, profits, and practical recommendations crucial for your business survival and growth. Skip the fluff and get straight to the strategies that matter—because in an industry evolving faster than a HIIT session, you need more than clichés.

“Your gym’s success demands more than buzzwords; it demands actionable intelligence. The details you’re looking for are right here.”

Introduction

In the fitness space, unlocking valuable insights often involves mirroring the methods of those who excel, much like refining your running technique by adopting the training routine of an accomplished marathon runner. The key lies in connecting with individuals who boast performance metrics beyond our own and replicating their training approaches. The crucial strategy lies in aligning with individuals whose performance metrics surpass our own and replicating their practices.

However, determining who is genuinely excelling poses a challenge. Assessing the greatness of my gym is subjective, as every gym owner believes in the greatness of their establishment. The dilemma then arises: Whom should we look at? Whose counsel should we heed? Who is struggling? – and even more important how do you use their insights in your own gym?

This is where this whitepaper comes in, if you have measurable parameters that determine success, you can compare yourself against others. Learn how they achieve it, and grow. These are often: #number of members, #average lifetime value, retention rate, pricing, gross margin, net profit margins, return and advertising spend and more.

Having this comparison data available gives you the opportunity to analyze your business. It poses questions such as:

Is Facebook advertising still effective? Should our social media efforts be increased or reduced? Is introducing a nutrition program beneficial? Does expansion or a second location make sense? Seek answers from this guide, which reveals the strategies employed by the top-performing gyms.

Remember, great gyms don’t materialize spontaneously; they result from focused, data-driven actions. A mentor, armed with this guide, can assist you in implementing strategies to propel your gym into the echelons of excellence.

This research is based on survey response of over 13.000 Gyms worldwide.

In 2023, a comprehensive data survey was conducted, encompassing a staggering sample size of over 13,000 gyms worldwide. This ambitious initiative sought to delve into the intricate landscape of the fitness industry, analyzing a diverse array of establishments to extract valuable insights. The survey aimed to capture a panoramic view of gym operations, encompassing factors such as client acquisition, revenue generation, and retention strategies. With a focus on obtaining a nuanced understanding of industry trends and best practices, this extensive survey provides a wealth of information that can serve as a guiding light for gym owners and industry professionals seeking to enhance their operational effectiveness and overall success in the fitness landscape of 2023 and onwards.

Section 1: How many clients does the average boutique gym have?

Establishing a solid foundation in a coaching gym often begins with a membership base of 150 individuals. This number proves advantageous in managing client turnover effectively. Additionally, serving this clientele within a 4,000-square-foot space aligns with optimal profitability, as later sections will elaborate. With 150 members, an owner has the potential to generate $100,000 annually and sustain a workforce comprising a full-time coach and a few part-time staff members. Crafting your strategy around acquiring and retaining 150 high-value clients forms the cornerstone. Subsequently, consider expanding your outreach or contemplating a second location. Designing your rates and models based on this 150-member framework not only ensures the viability of your gym but also facilitates its longevity. It’s worth noting that many gyms seldom surpass the 150-client mark.

Overall gym market growth in 2023. Are gyms gaining or losing clients?

Examining client growth trends in gyms globally reveals a consistent pattern across various regions. On average, the United States experiences a steady monthly growth rate of 3-6%, with the lowest figures recorded in December and the highest in January. Remarkably, the UK stands out with a peak growth rate exceeding 8% on average during January. Growth tends to dip from August, reaching its lowest point in December at 2-3%, only to rebound significantly to 6-8% in January. This heightened growth persists, maintaining an average of 5-6% month over month throughout the year. Cancellation rates present a different dynamic, with the peak occurring in September at 5-9%, notably highest in the UK. On average, cancellations hover between 4-5% each month, with the EU leaning towards 4% and the United States towards 5%. In summary, the global growth landscape in 2023 showcases an average growth rate of approximately 4% in the US, nearly 11% in Europe, and an average of about 5% in other regions.

Section 2: Client analysis

Within our research scope, we’ve seen a balanced distribution of male and female participants. Examining age demographics, a consistent trend is visible, with the 31-40 age range representing the largest segment across all regions, closely trailed by those aged 21-30. The 41-50 age bracket holds the third position, indicating a diverse age composition in our customer base. In terms of interests, our findings reveal that individuals in the 41-50 age group allocate a significant portion on personal training services, followed closely by those in the 31-40 age range.

Section 3: How are gyms gaining clients?

In the realm of gym marketing in 2023, the effectiveness of online advertising stands out as a key determinant of profitability. Notably, there exists a strong correlation between gyms that run successful ad campaigns and those that boast financial success.

Despite this, only 50 percent of gyms engage in advertising. Some gym owners express skepticism about the efficacy of ads, often due to a limited understanding of the entire marketing funnel. Ads, though pivotal, constitute just one element; success requires complementing them with lead nurturing, efficient appointment systems, and adept salesmanship. While a well-executed advertising campaign can be a game-changer, its impact can be compromised by inadequate sales practices. In the evolving landscape of boutique and micro gyms, marketing is indispensable.

Within Gamechangers, we advocate for four distinct marketing funnels, one of which involves leveraging paid ads. When comprehended and executed effectively, paid advertising proves to be a powerful tool for acquiring clients. However, it’s worth noting that some gym owners adeptly acquire clients without resorting to paid advertising, citing the effectiveness of organic campaigns and referrals as well as acknowledging a lack of skill with advertising as common reasons for abstaining from this approach. In summary, the landscape of gym client acquisition in 2023 underscores the significance of online marketing, with paid ads being a potent component of a comprehensive and well-executed marketing strategy.

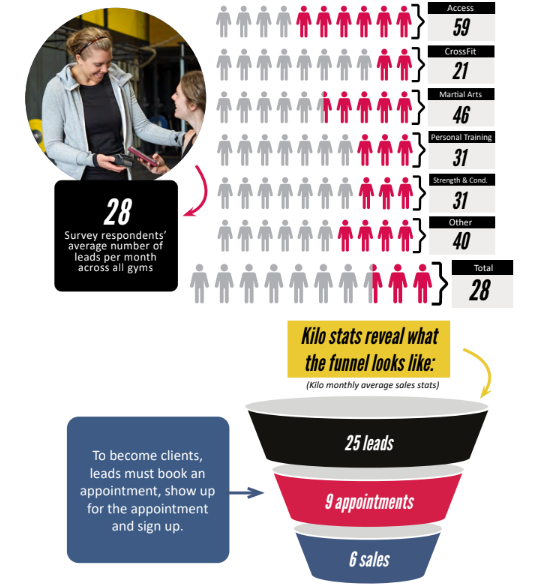

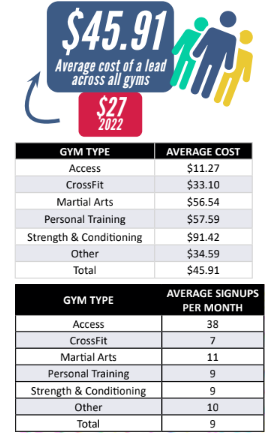

Average leads per month

Leads generated through social media, blogs, podcasts, and other media channels incur no discernible cost, thereby reducing the average cost of acquisition. However, it’s essential to recognize that cultivating these leads demands a significant investment of time. In the initial phases of owning a gym, time emerges as a precious asset, best utilized for lead generation with minimal ad spend. Nevertheless, as gyms mature, the most successful ones often incorporate paid advertising into their strategy. Understanding the cost of acquiring a client becomes pivotal, allowing gym owners to pinpoint the most impactful aspects of their marketing plans. If lead costs are prohibitively high, a greater emphasis on organic media posting may be the solution. Conversely, if lead costs are manageable, integrating paid marketing can expedite an already effective process. This nuanced approach enables gym owners to optimize their marketing efforts based on the evolving dynamics of cost and effectiveness.

On average, 7.3 new members are gained each month, across all channels and regions, the average cancellation per month is 5.3 members.

Section 4: How much do gyms earn all around the world?

Globally, gyms have demonstrated a fluctuating yet generally positive trend in average monthly revenue over the past year. From July 2022 to June 2023, the figures in USD, Euros, and Pounds Sterling have exhibited variations. The average monthly revenue across this period stands at $12,490.58, €9,749.58, $18,271.17, and £8,745.75, respectively. Noteworthy spikes in revenue are observed in January 2023, reaching $13,050, €9,903, $18,928, and £8,723, reflecting a robust start to the year. Conversely, December 2022 saw a slight dip in average revenue. These figures underscore the dynamic nature of the fitness industry, influenced by various factors such as seasonal trends, economic conditions, and evolving consumer preferences. As gyms navigate these fluctuations, understanding and analyzing these revenue patterns remain critical for strategic planning and sustainable growth.

What services are Gym’s selling? And what is the return.

1. Group training:

Determining the optimal number of group classes is pivotal for gym success, surpassing a mere assessment of quantity. Our findings underscore that client adherence improves notably when classes maintain a modest size, typically ranging from 7 to 13 participants, with a global average of 6.9. However, a substantial number of gyms still offer classes with fewer than four attendees, potentially impacting the overall client experience. Assessing class viability involves multiplying the average client payment per class by the number of participants. Wodify data reveals that 53 percent of gyms provide between 20 and 50 classes per week, with an average class attendance of 6.6 in 2022. The breakdown of average class sizes unveils intriguing trends, including a decline in gyms with classes of 1-4 people (from 71% to 47%) and an increase in gyms with classes of 5-8 people (from 27% to 43%). This shift reflects a positive trend where gyms prioritize more participants, enhancing efficiency and reducing costs. Running consistently large classes with over 10 attendees is rare, emphasizing the importance of tailored class sizes for optimal engagement and retention. Gyms are evolving to strike a balance between diverse class offerings and a more engaging experience, contributing to increased client satisfaction and better business sustainability.

Despite the theoretical profitability of the group model, challenges emerge from data spanning 13,444 gyms. The envisioned scenario of one coach working with 12 clients generating higher-margin revenue clashes with the reality of the average group comprising three to seven clients. This mismatch poses challenges for gym owners who’ve invested in space and equipment for 12. Moreover, many gyms undercharge for coaching, selling small-group coaching at large-group prices, straining finances. Gym owners facing this dilemma are left with three choices: coach extensively, pay low wages to coaches, or supplement with higher-value services like personal training. With increasing competition, especially in group exercise, a shift towards a higher-value coaching model becomes imperative for gyms to differentiate themselves. Detailed attendance patterns from Wodify highlight global trends, with Monday being the most attended day and Sunday the least. Gym attendance declines each day, with Thursday witnessing significant drops across regions, except Canada. This data emphasizes the need to adopt a higher-value model to counteract the commoditization of intense group exercise in a competitive market.

2. Personal Training

It’s not just encouraging to witness the gradual increase in the price of personal training (PT) over the past three years; it’s equally promising to observe a growing number of gyms incorporating PT into their offerings. PT stands out as a high-value service that not only supports gyms but also yields swift results for clients while creating additional income for trainers. Notable increases were observed in the percentage of Access, Martial Arts, and Strength and Conditioning gyms providing PT, with CrossFit and Personal Training gyms maintaining strong figures, both well over 90 percent. The sole decline occurred in the “Other” category.

Crucially, if the median group-training membership for an entire month is $165, gyms can match this income by selling just two PT sessions. The 9-point increase in Access gyms offering PT is particularly impactful, considering these gyms charge an average of $43 per month for uncoached facility access, while a single PT session commands an average of $67.

Examining client value further, the average 60-minute PT session price among survey respondents is $75. Personal training contributes significantly to overall revenue, constituting an average of 22% of total revenue for gyms offering 1:1 coaching. Notably, 93% of gyms across all categories, except for the “Other” category (81.3%), include PT in their offerings.

Breaking down the data by gym type, CrossFit gyms lead with a $75 average PT session price, closely followed by Strength & Conditioning and Martial Arts gyms. While Personal Training gyms boast the highest percentage of offerings (98.1%), Access gyms experienced a notable increase, reaching 94.7%.

In financial terms, selling two PT sessions proves more lucrative than acquiring three new members. For gym owners without personal training in their repertoire, the data strongly advocates considering its addition, emphasizing the potential revenue boost and the enhanced value it brings to both clients and trainers.

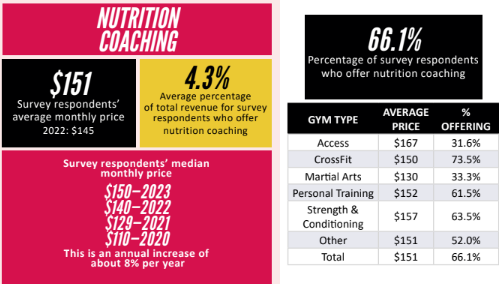

3. Nutrition coaching

When evaluating any service, the crucial question is whether it effectively addresses the needs of the client, coach, and gym owner. Nutrition coaching, in theory, appears to satisfy all three aspects by being potentially more scalable than group training, requiring less time from coaches, and eliminating the need for daily sessions. However, the reality is that prevalent models for delivering nutrition coaching are falling short.

Despite over 66 percent of gyms now offering nutrition programs, these programs, on average, contribute less than 5 percent to total revenue. After factoring in coach compensation, the net benefit is minimal, especially for gyms outsourcing nutrition coaching. Moreover, the challenge lies in clients’ limited commitment to nutrition coaching, with most participating for only a few months, rendering the model unsustainable for coaches in the long run.

A critical consideration is the duration clients engage with nutrition coaching and whether they maintain their habits post-program. If clients sign up for a three-month plan at $150 per month but discontinue afterward, questions arise about the true benefits for clients, gyms, and coaches. In light of these challenges, a more effective approach might involve running quarterly nutrition challenges or offering a regular “accountability” add-on instead of promoting a separate monthly service. This pragmatic shift aligns with data-driven insights, prioritizing real outcomes over theoretical ideals for a more practical and beneficial approach to nutrition coaching.

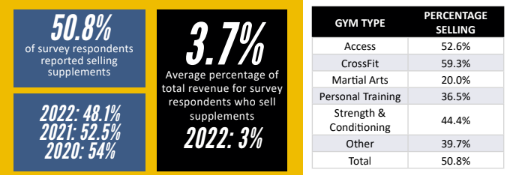

4. Supplements

The prevalence of gyms selling supplements has increased in the past year, thanks to resolved supply-chain issues. Supplements offer a dual value proposition: firstly, preventing members from misguided purchases elsewhere enhances your role as a knowledgeable coach; secondly, supplement sales are a high effective hourly rate (EHR) activity, requiring minimal ongoing maintenance after initial setup.

Take BioEdge, for instance, which efficiently manages inventory, handles payments, and restocks when necessary. The process is streamlined, requiring minimal effort since implementing a QR code system. Selling supplements proves to be one of the simplest ways to boost revenue, akin to raising rates or reducing transaction fees by 3.4 percent. Many gyms engage in supplement sales not just for profit but to provide quality products for their clientele.

Crucial to success is adopting a service that demands little ongoing maintenance, as the outdated approach of buying and storing inventory is ineffective. The key lies in leveraging streamlined systems to maximize revenue and client value without unnecessary time investment.

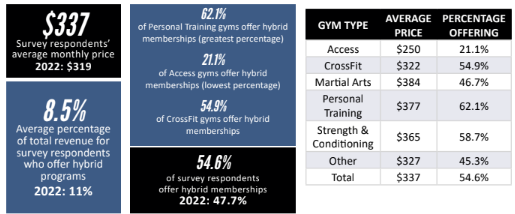

5. hybrid Programs

Hybrid packages, encompassing a blend of two or more services such as group classes, personal training, online coaching, or nutrition services, represent a versatile approach to fitness offerings. In the future, these comprehensive packages may be termed “high-ticket offers.” Analyzing 2023 data in comparison to the previous year reveals a noteworthy trend: the average price of hybrid packages has increased by $18. This suggests that gyms are now selling higher-value packages, emphasizing a shift towards more robust and comprehensive solutions for clients. This change underscores the significance of gyms addressing clients’ needs more comprehensively rather than merely providing exercise programs.

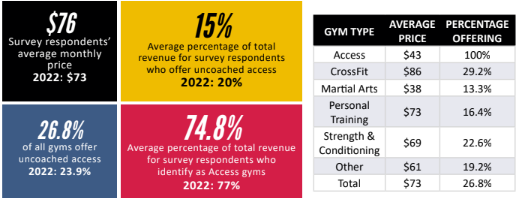

6. Uncoached Access

Access gyms inherently provide uncoached access, but a notable trend is emerging with an increasing number of CrossFit, Martial Arts, and Personal Training gyms offering this service. Interestingly, while fewer Strength and Conditioning and Other gyms are providing uncoached access, the overall percentage of gyms offering it has risen by 2.9 points from 2022 to 2023.

What adds intrigue to this shift is that coaching gyms selling uncoached access tend to charge double the price compared to access-only gyms. For instance, while Access gyms charge an average of $43, CrossFit gyms command $86. This raises two possibilities: these gyms are either positioning uncoached access as an alternative to their coaching programs or offering it as an add-on for clients already enrolled in coaching programs.

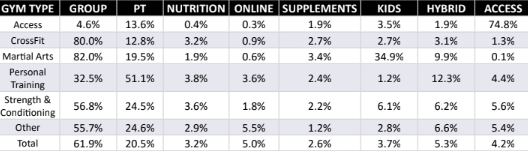

Summary, what is the percent of revenue?

This page serves as a compelling annual insight for gym owners. Firstly, it illuminates avenues for enhancing value to clients, translating into increased revenue. Secondly, it serves as a guide for owners to redirect their focus strategically.

The table meticulously dissects the average revenue contribution from each service stream across gyms in various categories. It’s crucial to note that input errors might result in totals that don’t precisely equal 100 percent. Such errors could stem from misattributed percentages or unlisted revenue sources that, while not significant enough for a separate category, can impact the overall total. For instance, some CrossFit gyms report 25 percent of revenue from sources beyond the segments listed, including specialty classes, diversified models, space rental, punch-card sales, and drop-in fees.

Despite potential discrepancies, the table offers discernible trends and valuable insights, presenting clear opportunities for revenue generation across diverse business categories.

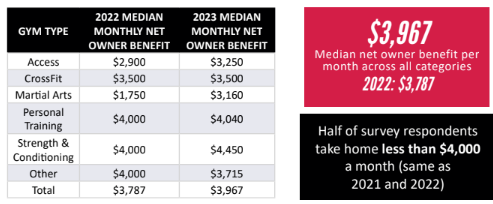

Section 5: What does a gym owner earn in 2023?

A successful business should not only transform the lives of its clients but also ensure the well-being of its owner. A business that doesn’t financially support its owner is unsustainable in the long run. To make a lasting impact in the fitness industry, it’s imperative to generate a good income. We gauge this as net owner take home, encompassing salary, dividends, and perks.

Earning $100,000 in net owner take home annually is achievable by establishing a business with the capacity to generate such revenue. Importantly, higher net earnings for owners doesn’t mean reduced income for staff; it’s not about greed but about expanding opportunities for everyone. By growing the overall business, owners create a more substantial and inclusive pie, benefitting staff members, enhancing the client experience, and truly making a positive impact on lives.

At Gamechangers, the average gymowner after 12 months of coaching takes home $5,972 per month.

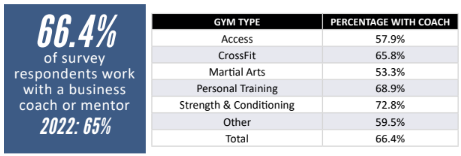

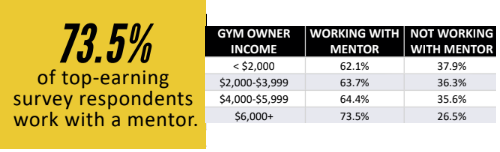

Section 6: How do you increase your likelihood of success?

While not all survey respondents are Gamechangers’ clients, a portion is. This could influence metrics such as revenue, net owner profit, and others. The data consistently indicates that gyms working with a business coach or mentor tend to demonstrate superior metrics. For those currently below average in any category, engaging with a mentor presents an opportunity to not only meet but surpass those benchmarks.

Section 7: Conclusion

Examining the data and insights gathered from hundreds of gyms in our mentorship program, a fascinating trend emerges—the global flow of trends across regions. From 2010 to 2014 in the U.S., acquiring CrossFit gym clients seemed straightforward; however, as competition intensified, owners had to enhance their business acumen. By 2018, U.S. affiliate owners were prioritizing marketing regularly.

A similar pattern unfolded in Australia a few years later, followed by Western Europe. Gym owners across these regions acknowledged the need to elevate their business strategies. As global lockdowns occurred, U.K., France, Ireland, and Nordic gyms faced the reality that the easy days were gone, mirroring past experiences in Canada and the U.S. A current trend in Spain, Portugal, and Western Asia echoes patterns observed a decade ago in Canada and the U.S., with high client counts but elevated churn rates.

History provides valuable clues, allowing us to predict future challenges and opportunities. For boutique and micro gyms, the current challenge is commoditization. New HIIT-style gyms in Australia and the West Coast of North America are offering group functional fitness at competitive prices. To combat commoditization, the data suggests focusing on building a strong foundation with minimum 150 members, investing in robust media presence, and charging a premium for exceptional services. The key is not to compete on price but to establish and showcase the unique value that justifies a higher cost. Be sure that everyone in your town knows about you, why you’re worth so much – and of course, be worth it!

Mentorship for gym owners.

Learn how to build and improve your fitness business.